Inflation news dominates an otherwise quiet economic calendar

Last Week in Review

“Anticipation … is keeping me waiting.” Carly Simon.

Between the April Jobs report, inflation news and the Fed meeting, investors had plenty to anticipate in the latest week.

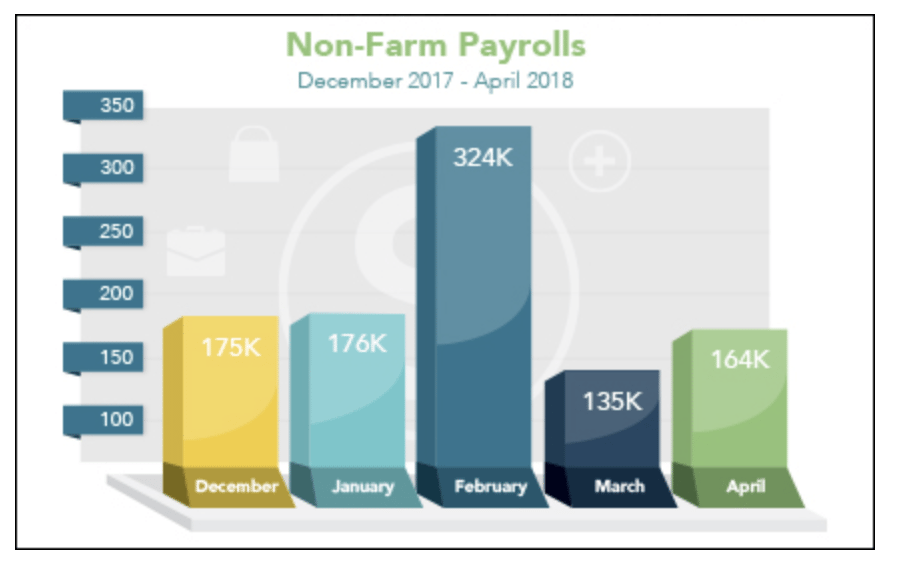

The Jobs Report for April was a bit of a disappointment, as job creation rose from March but came in below expectations. There were 164,000 new jobs added in April, below the 190,000 expected, the Bureau of Labor Statistics reported. This was up, however, from the 135,000 recorded in March (which was revised higher from 103,000). The Unemployment Rate fell to an 18-year low of 3.9 percent. Wage growth fell to 2.6 percent on an annual basis, down from the 2.9 percent recorded in January. Month-over-month hourly earnings rose 0.1 percent versus the 0.2 percent expected.

The Fed’s favorite inflation measure, annual Core Personal Consumption Expenditures (PCE), showed that inflation rose 1.9 percent in the 12 months through March. This was up from the 1.6 percent annual increase recorded in February. The Core reading excludes volatile food and energy prices. March’s number was the biggest increase since February 2017, and it brings annual Core PCE closer to the Fed’s target of 2.0 percent.

Inflation reduces the value of fixed investments, like Mortgage Bonds, meaning inflation can hurt Mortgage Bonds and the home loan rates tied to them. It will be important to see if signs of inflation remain in the air.

The Fed met and, as expected, left its benchmark Fed Funds Rate unchanged at 1.5 to 1.75 percent. This is the rate at which banks lend money to each other overnight, and it is not directly tied to home loan rates. The Fed noted, as mentioned above, that inflation has moved closer to its 2.0 percent target, employment growth has been strong, and that the economy is growing at a moderate rate.

Over in the housing sector, high demand plus a limited supply of homes for sale on the market pushed home prices higher in March. Research firm CoreLogic reported that home prices, including distressed sales, rose 7 percent from March 2017 to March 2018, while there was a 1.4 percent gain from February to March. Looking ahead, CoreLogic forecasts a 5.2 percent rise in home prices from March 2018 to March 2019.

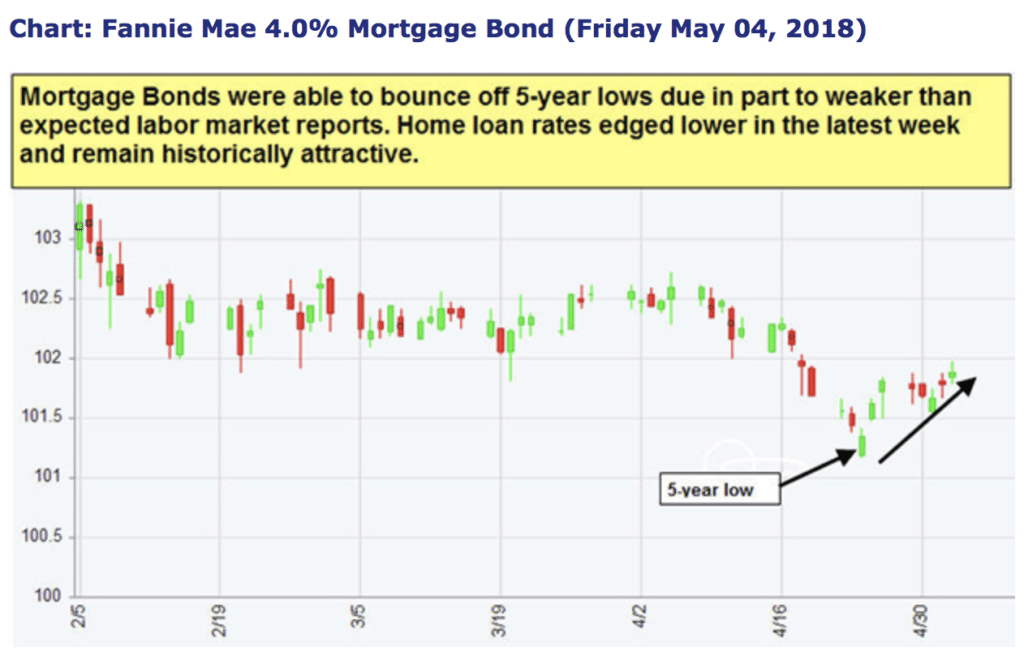

Despite the warm inflation reading, the disappointing labor market news in part helped Mortgage Bonds bounce off five-year lows. Home loan rates improved this week and remain historically attractive.

If you or someone you know has any questions about rates or home loans, please get in touch. I’d be happy to help.

Forecast for the Week

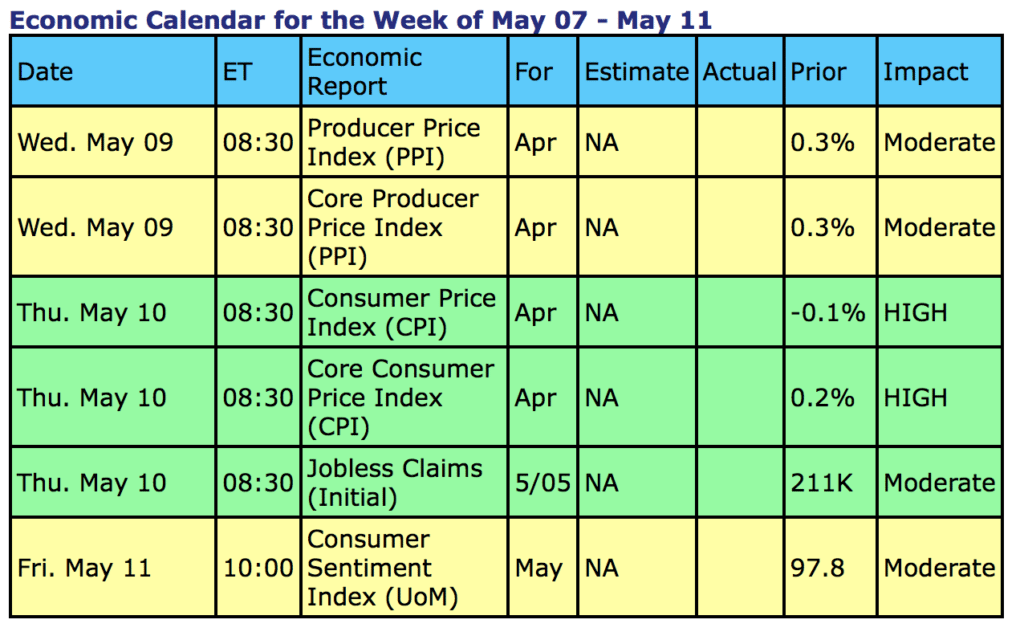

News on both consumer and wholesale inflation could impact Mortgage Bonds and home loan rates.

Reports begin Wednesday with the Producer Price Index, which measures wholesale inflation. The Consumer Price Index follows on Thursday.

Also on Thursday, weekly Initial Jobless Claims will be released.

The Consumer Sentiment Index will be delivered Friday.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve. In contrast, strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond on which home loan rates are based.

When you see these Bond prices moving higher, it means home loan rates are improving. When Bond prices are moving lower, home loan rates are getting worse.

To go one step further, a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes are on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning.

As you can see in the chart below, Mortgage Bonds were able to move higher in the latest week. Home loan rates edged lower and remain near historic lows.

Chart: Fannie Mae 4.0% Mortgage Bond (Friday May 04, 2018)

Japanese Candlestick Chart

The Mortgage Market Guide View…

4 Meaningful Social Media Content Ideas for May

Social media is one of the most useful tools for keeping clients and prospects engaged, demonstrating your expertise and expanding influence in your market. But coming up with things to post isn’t always easy! Here are four great ideas to help inspire your social media activity this month.

Share a memorable lesson that celebrates the contribution of the teachers, mentors and educators in your life. Offer a few suggestions for National Teacher Day gift ideas, which falls on the first Tuesday (May 8) of Teacher Appreciation Week.

This year, Mother’s Day is May 13 and provides an opportunity to honor the mothers in our lives. Ask followers for their top “Advice From Mom” (and whether they listened or not!). In addition, you can help local businesses by recommending your favorite restaurants and activities for celebrating the occasion.

Take time to remember the sacrifice of armed services personnel who have given their lives to protect our country and freedoms on Memorial Day (May 28) with a short note of appreciation. You can also highlight any parades or other commemorative activities happening in your community.

Be the first to share breaking news about industry related topics or newsworthy items you know your fans and followers are interested in. Set up Google Alerts on any topic, keyword or person and Google will notify you by email when there’s something new. Consider also setting alerts for nearby town names, so you can keep track and share information about local news, festivals, events and more.

Stay tuned next month for even more great social media content ideas!

Sorry, the comment form is closed at this time.